For something that impacts every single part of our lives, as women we don’t talk about money casually enough.

We talk about where to find the best pasta in the city, our questionable dating history, and the shows we’re binging. But money? That’s where things get quieter. Maybe it feels too flauty, too taboo, or like something we should already understand.

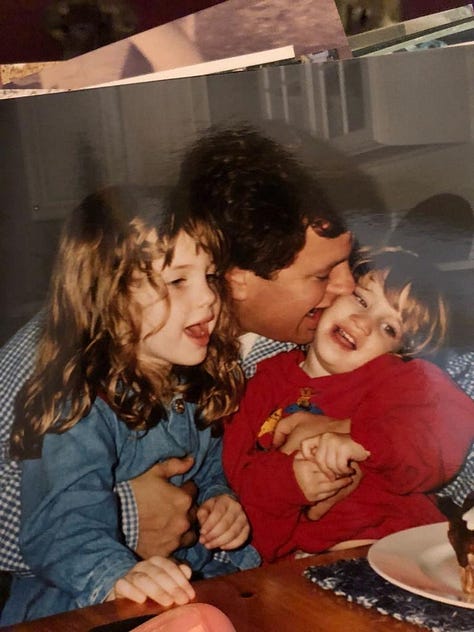

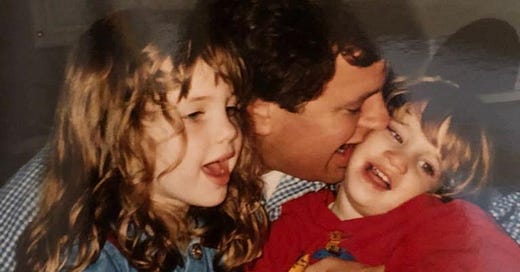

Growing up, my parents always told me (among many things you’ll see below), Money won’t make you happy, but it will make your life easier by giving you choices. I assumed money was just something you earned, spent, and saved when you could. But over the years, I started to realize it wasn’t just about having money—it was about what you do with it. Whether I realized it or not, my relationship with money was being shaped by little lessons along the way. So this is a very personal look at a few of them through my life:

Lesson One: Own the Soil & You Get to Decide What To Plant.

When I was a kid and I’d tell my dad I wanted to open my own store, he’d smile and say, You can do that, but own the building it’s in. Own the soil.

As a sassy 13-year-old, I rolled my eyes. I wanted a shop with the lipgloss that had shimmery stars in it from LimitedToo, not real estate advice. But what he was saying - what took me years to actually absorb - was that if you control the foundation, you control your choices.

If the business works? Great. If it doesn’t? You still own something that generates income. You still have options. I get that everyone can’t go out and buy a building, but the key to money is not just making it, but making it work for you.

Lesson Two: The Birthday Money I Never Saw

Growing up, my parents never let me or my siblings keep any of the birthday, holiday money or any monetary gifts we got. You can say that I was very jealous of the cool girls in school who used to say they used their birthday money to buy a new bag charm for their cool new backpack.

“It’s being invested,” they’d say. “You’ll thank us later.”

At the time, I didn’t think much of it. I just pouted. I figured they were just being overly practical, maybe even a little unfair. But 33 years later? That money - invested in ETFs, mutual funds, and stocks - has compounded into mid-six figures & is growing.

What felt like losing out as a kid was actually the future me gaining security. Money that had been quietly growing, working in the background, whether I was paying attention or not.

Now I understand here this was an insane privilege to both get excessive monetary gifts from family and friends (as well as having a father who knew what to do with it) but in my story of life, it taught me how that can grow.

Lesson Three: The Salary Shock

At 22, I got my first corporate job, and I was so proud of that $40k salary. Until I got my first paycheck.

Taxes in NYC took a serious bite I wasn’t expecting. Bills and real-life NYC expenses (of a much-to-decedent smoothie form Juice Generation) added up faster than I’d imagined. I realized that if I wanted financial freedom, a salary alone wasn’t going to cut it.

I had to learn not just to save but to invest (& pick up side gigs). To make sure my money wasn’t just sitting there but was actively working for me, building something bigger than a number in a bank account.

No doubt that at that age I was able to turn to my parents as my teachers. Because how do you even start? Is $100 too small? How do you know how much or what to invest in? What’s a fund? What the hell are dividends? How do taxes work with investments? No question is a stupid question when it comes to investing because everyone is still figuring it out.

But with starting small & opening another investment account that I controlled, I learned to make tiny investments that would slowly grow. Some months I would put around $100 into it, and other’s I would put $1000 in it (through those side gigs I worked and after a year of work at my corporate job my boss quit, and I took over her job which led to an increase in salary to 95k). No matter the month, I always added something, even if it was just $30. Some of those investments (Vangaurd, Microsoft, etc.) I’ve held on to till today, and others (Soho House…murp…) were fun ways of learning that you can lose money very quickly when you invest in something that’s trendy.

Lesson Four: Buying Myself Time

By 25, I wanted to move to Amsterdam. I had saved enough “Let’s do this” money on the side through my jobs & investments to be able to quit, rely on myself, and make that choice.

€36k, that’s what I had in case no one wanted to hire me.

Enough for rent, expenses, life, MFU’s (Major Fuck ups) and everything in between. That gave me €3k per month to see if I could make Amsterdam my home.

That decision - giving myself an entire year to explore, to figure out what I wanted - wasn’t something I could have done if I hadn’t been thinking ahead. Money, at that moment, didn’t just give me things. It gave me time. And time is, arguably, the greatest luxury of all.

I was able to move here, try out a few gigs (hate them), stay in a few questionable apartments with questionable roommates, and find my footing while knowing my main investment account was still making money while I rested my head on a questionable pillow (oh, to be 25 again…).

Within 4 months, I landed a freelance gig at one of the best Ad Agencies in the world, and that became my primary home for income for the next 5 years.

Depending on how many months I wanted to work, I would make anywhere from €110 - 150k in that world a year. But that was hard work. Like waaay over 40+ hours a week work. As a 26-year-old, I felt exhausted by what I was doing, but I was chasing the money. I knew the Ad realm wasn’t my end goal, but it was the way to get myself on my feet in the new city I called home.

Lesson Five: Betting on Myself

In 2022, when I decided to really kickstart & the Table into a company, it wasn’t a salary that kept me afloat. It was again the money I had invested over the years, the money that had been growing, the money that allowed me to build something without scrambling for side gigs or rushing to monetize in weird ways too soon.

Don’t get my wrong, I saved up a lot from the 5 years of working in Advertising in Amsterdam & with my investments… but… I knew that if in the beginning & the Table I needed to invest €20k to get it started & was only making €5-6k in revenue per month, I had €3-4k in expenses & I needed cash flow to build up over time - paying myself the first 6 months to a year wasn’t possible. I needed to rely on both those savings and knowing my invested money was still making money. I didn’t want to take on outside capital because I don’t want to pump and dump this company (if you havn’t noticed, dinner with strangers is kindof a thing now lol) it’s a lifelong build that will no doubt take twists and turns but I am able to do it my way.

So… I was able to do that and continue to do it that way today, but now the company is fully in the green.

My Overall Thoughts on the matter…..

We don’t talk about money enough.

I was even hesitant to share some of these numbers because there was something about it that created a tension within my body. But when we shy away from it, we sometimes feel like we should know more, so we don’t ask.

So whether it’s talking about it with your parents or your friends or joining me at one of our next tables where we speak through all things money - it gives us the power to make informed decisions and make it work for us.

I hope to see some of you at the table.

xx Sam

Love this Sam!! Very honest, and a much-needed conversation to open!!

This was a brilliant read, thank you. And I'm so happy I've discovered you & your company. Will definitely be signing up to a dinner soon x